Finding the right balance between retail staffing and achieving long-term financial targets often leaves business budget planners off-kilter. As expense pressures continue to rise with minimum wage increases and higher customer expectations, retailers are more motivated than ever to optimize their labor productivity while empowering their employees to the fullest.

When annual budget time rolls around, retailers look to influence store staffing structures, define wage-growth assumptions, and incorporate new initiatives into operational plans. The annual budget process is also a powerful mechanism to align store incentives with the overall objectives of the company. The process is part science and part art, involves many areas across an organization, and can take weeks, if not months, to complete.

And yet, the ever-changing and volatile retail world of today often means that annual budgets lose value as fast as a new car driving off the lot. But we’re here to say that, despite our current tumultuous retail ecosystem, you can have your forecast and meet it too.

The key lies in harmonizing your planning processes, data, and assumptions – and the results are transformational on all levels. Senior management will have increased insight and control, and not just once a year when budgets are created. Finance will be more accurate in projecting results and gauging performance to targets. Operations will be fairer in pushing/pulling store budgets according to their specific needs. Store managers will be empowered to adapt to today’s environment and tomorrow’s trends without fear of being measured against yesterday’s goals. And Employees will see fewer gaps in their scheduled hours versus the workload asked of them, and will experience fewer inconsistencies across stores.

To drive the most value, Axsium recommends you embark on the following four steps:

- Align “top-down” and “bottom-up” methodology and planning assumptions

- Adapt store level metrics and incentives to meet the overall business goals

- Adopt a continuous forecast regimen that informs and maintains the budget

- Advance your capabilities and collaboration with a more end-to-end toolset

In this first blog post of our four-part series, we’ll look at how aligning “top-down” and “bottom-up” planning approaches will link long-term financial targets with short-term operations planning structures, assumptions and methods – and help your bottom-line.

Align “Top-Down” and “Bottom-Up” Planning

Traditionally, short-term planning takes the “bottom-up” approach. That process used to sit mostly with store or district managers, and relied heavily on experience and shared rules of thumb. At best, an Excel-based tool was used to capture data and project sales and labor. But over the past couple of decades, retailers have invested in enterprise systems which drive more centralization and automation into the process. Now, field leaders are likely to benefit from a systematically generated volume and labor forecast three to four weeks in advance for scheduling purposes. Operators are also moving to use the same methodology for setting operational plans for the period, but there’s often a disconnect between these and longer-term financial budgets.

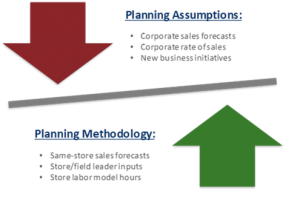

Long-term budgets, on the other hand, most commonly take a more “top-down” approach. Financial targets are generally based on year-over-year growth and the process to translate corporate goals to the store level is often a less-than-scientific one. We often see the pain or gain distributed evenly across the stores, regardless of the need. Other times, field leaders play a role in softening the edges, but this practice can also cause inefficiencies due to favoritism or sandbagging. If these behaviors and biases are institutionalized, an asymmetry in productivity performance will occur in similar stores.

We find that most retailers struggle with connecting all the dots between long-term financial planning and short-term operations planning. While many operations teams have developed advanced “bottom-up” planning processes by deploying detailed labor models to their workforce management (WFM) system, it still isn’t very common for the finance teams managing the proverbial purse strings to have all this great information at their disposal. Sometimes, it can come down to a tenured financial analyst, who is convinced that their tried and true approach to building budgets need not be influenced by some upstart from operations. Most of the time, it’s just a result of insufficient formal information-sharing between teams and inadequate time spent on improving internal processes.

Driving change into long-standing organizational processes can be difficult, but this lack of integration between “top-down” and “bottom-up” processes is undoubtedly having a direct effect on your bottom line. When staffing assumptions don’t tie out (e.g. WFM sets minimums by job/day, whereas Finance determines base coverage at the weekly level), stores might, for example, be scheduled for fewer hours than their minimum budget calls for, and thereby missing out on sales. Or when organizational structures aren’t the same (e.g. WFM forecasts by the job, whereas Finance budgets at the total store level), the results are more difficult to track, and corrective action (if needed) is less precise to execute.

To help empower your stores and drive more consistent performance across your organization, we recommend that you align with your finance partners on input parameters and push for them to start their budgeting process in “bottom-up” fashion. This will not only minimize discrepancies between budgets and forecasts, but will also usher in a more fact-based and store-focused environment for the inevitable horse-trading that ensues. Of course there’s a perennial need to adapt the “art” of setting annual budgets, but we find that applying the “science” of operational forecasting creates the best canvass for decision-making.

Stay tuned for our next blog on “Adapting Store-level Metrics and Incentives to Meet Your Overall Business Goals”. Until then, feel free to reach out to Al Asgarian at aasgarian@axsiumgroup.com, Luke Muellerleile at lmuellerleile@axsiumgroup.com, or your primary Axsium contact with any questions or to schedule a discovery call. We’re always happy to sit down with you and discuss options to plan, design and/or implement any of these recommendations within your organization.